Hsn Code For Bakery Products Under Gst . The hsn code for bakery products in india depends on the specific. Currently, branded snacks are taxed at 12% and pastries/cakes are taxed at 18%. what is the bakery products hsn code and gst rate? goods and services tax (gst) applies to cakes and pastries. gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. what is the gst rate on bakery products? Our cleartax gst software has all the hsn. basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower gst rate of 5%. This article will clarify how gst affects cakes. 121 rows use cleartax hsn calculator to find out the hsn code for your product. 20 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 1905 bread, pastry, cakes, biscuits and other bakers'.

from www.registerexperts.com

20 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 1905 bread, pastry, cakes, biscuits and other bakers'. what is the gst rate on bakery products? what is the bakery products hsn code and gst rate? basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower gst rate of 5%. Currently, branded snacks are taxed at 12% and pastries/cakes are taxed at 18%. goods and services tax (gst) applies to cakes and pastries. gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. The hsn code for bakery products in india depends on the specific. 121 rows use cleartax hsn calculator to find out the hsn code for your product. This article will clarify how gst affects cakes.

How To Find HSN Code For GST? RegisterExperts

Hsn Code For Bakery Products Under Gst basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower gst rate of 5%. This article will clarify how gst affects cakes. basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower gst rate of 5%. gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. Currently, branded snacks are taxed at 12% and pastries/cakes are taxed at 18%. what is the bakery products hsn code and gst rate? The hsn code for bakery products in india depends on the specific. Our cleartax gst software has all the hsn. 20 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 1905 bread, pastry, cakes, biscuits and other bakers'. what is the gst rate on bakery products? goods and services tax (gst) applies to cakes and pastries. 121 rows use cleartax hsn calculator to find out the hsn code for your product.

From zeconcile.com

Understanding HSN Code under GST ZeConcile Hsn Code For Bakery Products Under Gst gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. Our cleartax gst software has all the hsn. 121 rows use cleartax hsn calculator to find out the hsn code for your product. what is the gst rate on bakery products? what is the bakery products hsn code and gst rate? goods. Hsn Code For Bakery Products Under Gst.

From instafiling.com

HSN Code List and GST Rates 2022 (Updated) Hsn Code For Bakery Products Under Gst basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower gst rate of 5%. what is the bakery products hsn code and gst rate? This article will clarify how gst affects cakes. The hsn code for bakery products in india depends on the specific. 121 rows use cleartax. Hsn Code For Bakery Products Under Gst.

From www.captainbiz.com

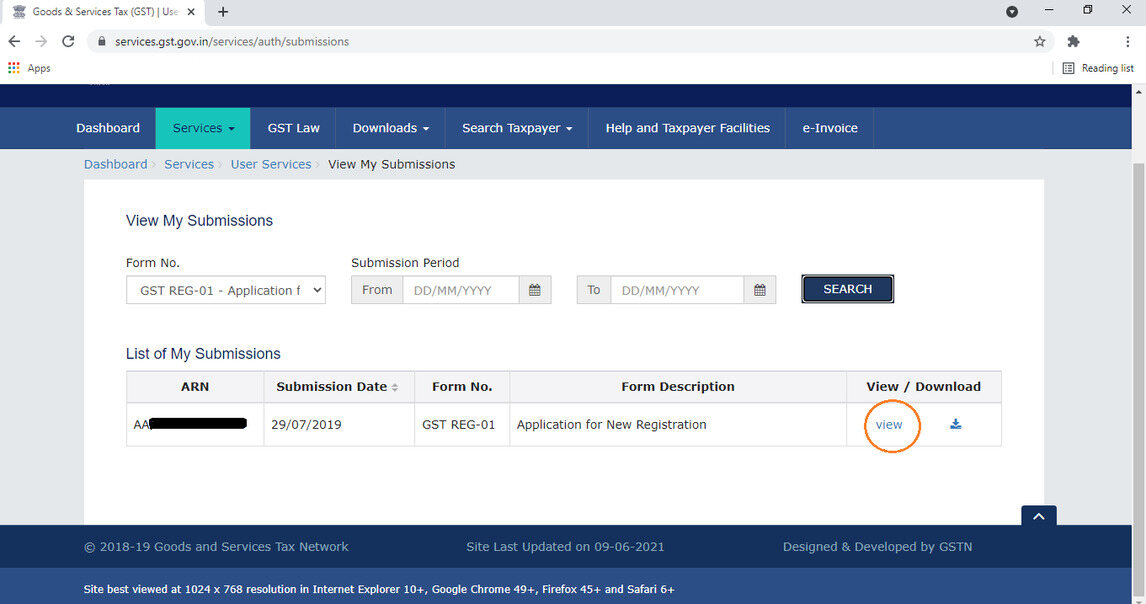

How to Add HSN Code in GST Portal A StepbyStep Guide Hsn Code For Bakery Products Under Gst Our cleartax gst software has all the hsn. basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower gst rate of 5%. gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. what is the gst rate on bakery products? what is the bakery. Hsn Code For Bakery Products Under Gst.

From www.onlinelegalindia.com

Things You Need to Know About HSN Code in GST Hsn Code For Bakery Products Under Gst The hsn code for bakery products in india depends on the specific. Currently, branded snacks are taxed at 12% and pastries/cakes are taxed at 18%. what is the gst rate on bakery products? 20 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 1905 bread, pastry, cakes, biscuits and other bakers'.. Hsn Code For Bakery Products Under Gst.

From cevettlp.blob.core.windows.net

Cotton Tape Hsn Code And Gst Rate at Joseph Hudson blog Hsn Code For Bakery Products Under Gst The hsn code for bakery products in india depends on the specific. This article will clarify how gst affects cakes. Currently, branded snacks are taxed at 12% and pastries/cakes are taxed at 18%. Our cleartax gst software has all the hsn. basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a. Hsn Code For Bakery Products Under Gst.

From help.tallysolutions.com

How to Manage HSN Codes/SAC and Tax Rates in TallyPrime TallyHelp Hsn Code For Bakery Products Under Gst basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower gst rate of 5%. The hsn code for bakery products in india depends on the specific. what is the gst rate on bakery products? goods and services tax (gst) applies to cakes and pastries. gst rates and. Hsn Code For Bakery Products Under Gst.

From apps.apple.com

GST HSN Code on the App Store Hsn Code For Bakery Products Under Gst This article will clarify how gst affects cakes. what is the bakery products hsn code and gst rate? what is the gst rate on bakery products? The hsn code for bakery products in india depends on the specific. basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower. Hsn Code For Bakery Products Under Gst.

From ebizfiling.com

The 8Digit HSN Code is the Key to Understanding GST Rates Hsn Code For Bakery Products Under Gst 121 rows use cleartax hsn calculator to find out the hsn code for your product. what is the gst rate on bakery products? This article will clarify how gst affects cakes. Our cleartax gst software has all the hsn. 20 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 1905. Hsn Code For Bakery Products Under Gst.

From www.registerexperts.com

How To Find HSN Code For GST? RegisterExperts Hsn Code For Bakery Products Under Gst Our cleartax gst software has all the hsn. what is the gst rate on bakery products? 20 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 1905 bread, pastry, cakes, biscuits and other bakers'. This article will clarify how gst affects cakes. what is the bakery products hsn code and. Hsn Code For Bakery Products Under Gst.

From dxotvfesa.blob.core.windows.net

Hepa Filter Hsn Code And Gst Rate at Mary Bulloch blog Hsn Code For Bakery Products Under Gst Our cleartax gst software has all the hsn. 20 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 1905 bread, pastry, cakes, biscuits and other bakers'. gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. 121 rows use cleartax hsn calculator to find out the hsn. Hsn Code For Bakery Products Under Gst.

From aliciawatts.z13.web.core.windows.net

Colour Powder Hsn Code Hsn Code For Bakery Products Under Gst This article will clarify how gst affects cakes. 121 rows use cleartax hsn calculator to find out the hsn code for your product. 20 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 1905 bread, pastry, cakes, biscuits and other bakers'. Currently, branded snacks are taxed at 12% and pastries/cakes are. Hsn Code For Bakery Products Under Gst.

From rtocodelist.in

GST Code List 2023 GST Rate List 2023 PDF RTOCodeList Hsn Code For Bakery Products Under Gst goods and services tax (gst) applies to cakes and pastries. what is the gst rate on bakery products? Our cleartax gst software has all the hsn. 20 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 1905 bread, pastry, cakes, biscuits and other bakers'. Currently, branded snacks are taxed at. Hsn Code For Bakery Products Under Gst.

From www.youtube.com

HSN CODE FOR GST PRODUCT WISE GOODS & SREVICE DESCRIPTION (PART 30 Hsn Code For Bakery Products Under Gst Our cleartax gst software has all the hsn. The hsn code for bakery products in india depends on the specific. what is the gst rate on bakery products? what is the bakery products hsn code and gst rate? basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower. Hsn Code For Bakery Products Under Gst.

From vakilsearch.com

HSN Code and GST Rate for Fruits and Dry Fruits Hsn Code For Bakery Products Under Gst basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower gst rate of 5%. This article will clarify how gst affects cakes. what is the gst rate on bakery products? gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. 121 rows use cleartax. Hsn Code For Bakery Products Under Gst.

From www.youtube.com

How To Know HSN Code of GST Registered Person How to Check Registered Hsn Code For Bakery Products Under Gst what is the bakery products hsn code and gst rate? Currently, branded snacks are taxed at 12% and pastries/cakes are taxed at 18%. what is the gst rate on bakery products? gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. The hsn code for bakery products in india depends on the specific. . Hsn Code For Bakery Products Under Gst.

From www.youtube.com

GST HSN Code Mandatory on INVOICE and GSTR1 from 1st April 2021 GST Hsn Code For Bakery Products Under Gst Our cleartax gst software has all the hsn. Currently, branded snacks are taxed at 12% and pastries/cakes are taxed at 18%. The hsn code for bakery products in india depends on the specific. goods and services tax (gst) applies to cakes and pastries. basic bakery products such as bread and plain buns, without any additional toppings or fillings,. Hsn Code For Bakery Products Under Gst.

From gst-partner.blogspot.com

HSN Code & GST Tax Rate List for General Store and Kirana Items GST Guide Hsn Code For Bakery Products Under Gst what is the bakery products hsn code and gst rate? gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. what is the gst rate on bakery products? goods and services tax (gst) applies to cakes and pastries. 121 rows use cleartax hsn calculator to find out the hsn code for your. Hsn Code For Bakery Products Under Gst.

From blog.saginfotech.com

New List of GST Rates & HSN Codes on All Stationery Items Hsn Code For Bakery Products Under Gst basic bakery products such as bread and plain buns, without any additional toppings or fillings, typically attract a lower gst rate of 5%. This article will clarify how gst affects cakes. gst rates and hsn code for bread, pastry, cakes, biscuits, other bakers wares. Currently, branded snacks are taxed at 12% and pastries/cakes are taxed at 18%. . Hsn Code For Bakery Products Under Gst.